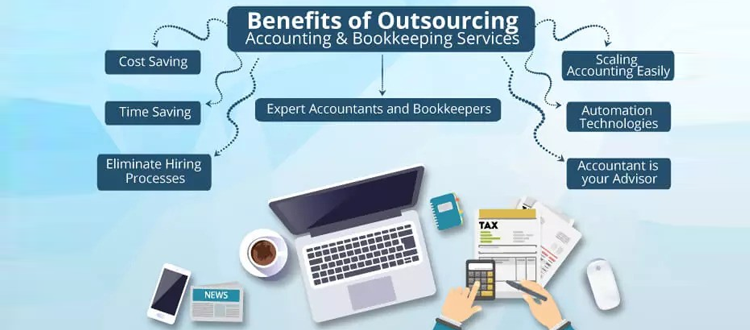

Due to its minimal overhead, Outsourcing Accounting Services is prevalent among contemporary businesses. Outsourcing makes it possible to achieve several benefits, including cheaper costs and more effective operations. However, it’s crucial to take security and privacy safeguards while outsourcing financial duties. Here are some recommendations for maintaining the security of your financial data while utilizing a third-party accounting provider.

1] Pick A Reliable Company To Handle Your Needs:

If you decide to use an outside firm to handle your accounting, choose one with a solid reputation for protecting client information. Look for evidence that the supplier has met international standards for information security management, such as ISO 27001.

2] Implement Multi-Factor Authentication And Use Complex Passwords:

Strong passwords and multi-factor authentication (MFA) are crucial for protecting your accounting systems. Insist that your outsourcing partner does the same thing. Password security depends on using diverse, complicated passwords that are often changed.

3] Limit Who Can See What And Set Up Role-Based Access:

Role-based permissions may be used to restrict who can see private financial information. This method lessens the chances of theft or other security breaches.

4] Maintain A Consistent Auditing And Monitoring System:

Keep your outsourced accounting audited and monitored regularly to ensure the security of your sensitive data. Log files, attempted logins, and other pertinent metrics should be monitored to detect malicious or unauthorized actions. Set up reliable intrusion prevention and detection systems to identify and stop security breaches as they happen.

5] Safeguard Your Data By Backing It Up Regularly:

Find out how your outsourcing partner stores and protects data. The safest place for your financial information is on a data center server that employs physical and electronic safeguards. You should back up your data on a regular basis in case of hardware failure, natural catastrophe, or cyber assault. Make sure your data can be swiftly recovered in the event of a calamity by asking about their disaster recovery strategy.

6] Keep Your Hardware And Software Up-To-Date:

Security flaws are expected in outdated software and hardware. Ensure your outsourced accounting provider is using the most recent version of the software and applying all necessary security patches and upgrades regularly. This method lessens the likelihood of illegal entry and protects against previously discovered flaws.

7] Communicate The Importance Of Data Protection To Your Staff:

The protection of personal information is everyone’s job. Inform your staff of the value of protecting their personal information, the perils of security lapses, and the best methods for maintaining data integrity. Drive home the importance of secrecy and following data privacy regulations. Good data privacy standards should be reinforced consistently across your business.

8] Maintain A Schedule Of Routine Security Checks:

Finally, be sure to do regular security evaluations so you can gauge the success of your data privacy precautions. Find any loopholes or security flaws by conducting an audit or an internal review. To keep ahead of developing dangers, it is important to regularly evaluate and update your data privacy policies and processes based on the results of these evaluations.

Conclusion

Accounting outsourcing may be helpful for businesses, but it’s essential to protect sensitive information. By adhering to these guidelines, your business will be able to reduce its risk exposure, keep its financial data safe, and maintain a productive outsourcing partnership.